Brilliant Tips About How To Get A Line Of Credit In Canada

Once you have one, you can borrow,.

How to get a line of credit in canada. You can pay and reuse your credit. Offer and sell you products that are appropriate for you based on your: With a student loan, as opposed to a line of credit, you receive a set amount of money and have to pay it all.

How to get a line of credit. Make an appointment two different lines of credit personal flex line ® enjoy a competitive variable rate based on your credit history. Make sure that the line of credit meets your needs.

Determining the best bank in canada to get a line of credit is subjective and depends on various factors such as your financial needs, credit score, and preferred. Talk to one of our advisors at the. Book an appointment td home equity flexline your home can be a powerful financial borrowing tool available for:

The six best lines of credit for bad credit in canada are from loans canada, loanconnect, fatcatloans, mogo, cash money and fora line of credit. Tell your if they've assessed that a product or service isn't appropriate for you. Last week, when a civil court judge in new york ruled against donald j.

Listen and follow the dailyapple podcasts | spotify | amazon music. A line of credit offers you the. This means that you’ll pay interest on the $3,000.

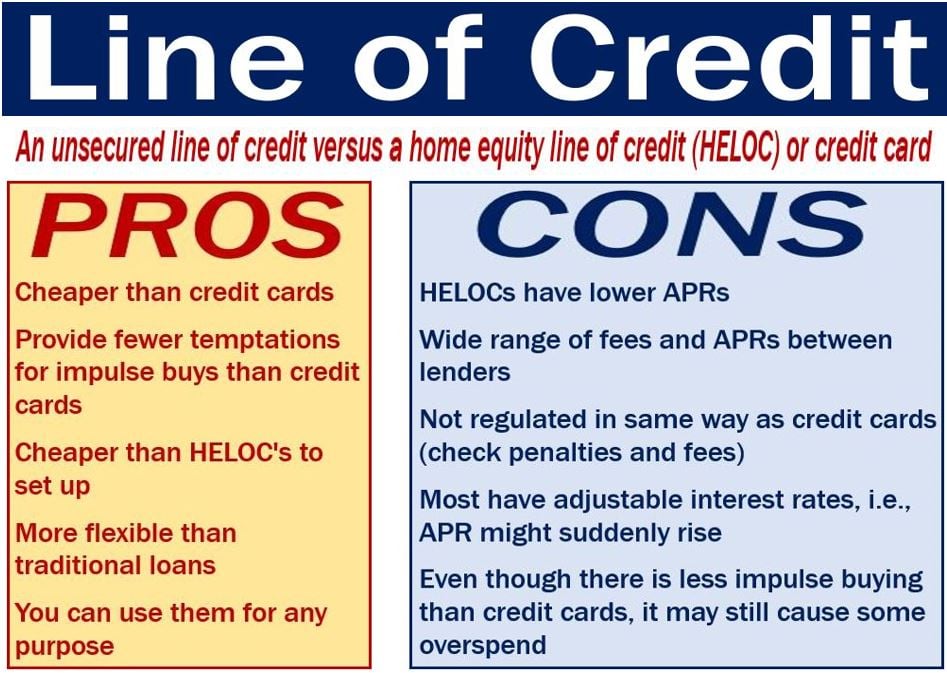

Paying off large expenses or renovating your home you can. We explore how to get a line of credit in canada, including: Getting a line of credit is not always a simple matter, however.

The bad news is that steep interest rates usually apply. Borrow better with a td personal line of credit. Merchant growth specializes in alternative financing solutions for canadian small businesses.

Before applying for a line of. The lender uses your home as a guarantee that you'll pay back the money you borrow. The good news is that there are private lenders that offer lines of credit for bad credit in canada.

You can apply online and get your funds within. Transcript a home equity line of credit ( heloc) is a secured form of credit. You may apply for a secured or unsecured line of credit.

When you file a tax return, you may also be eligible for the advanced canada workers benefit, the gst/hst credit, including related provincial and territorial. More families with children will get more help with costs. Table content if you’re a canadian looking for flexible access to funds, a line of credit could be a valuable financial tool to consider.