Best Of The Best Tips About How To Get A Tax Exempt Card

How to get a tax exempt card :

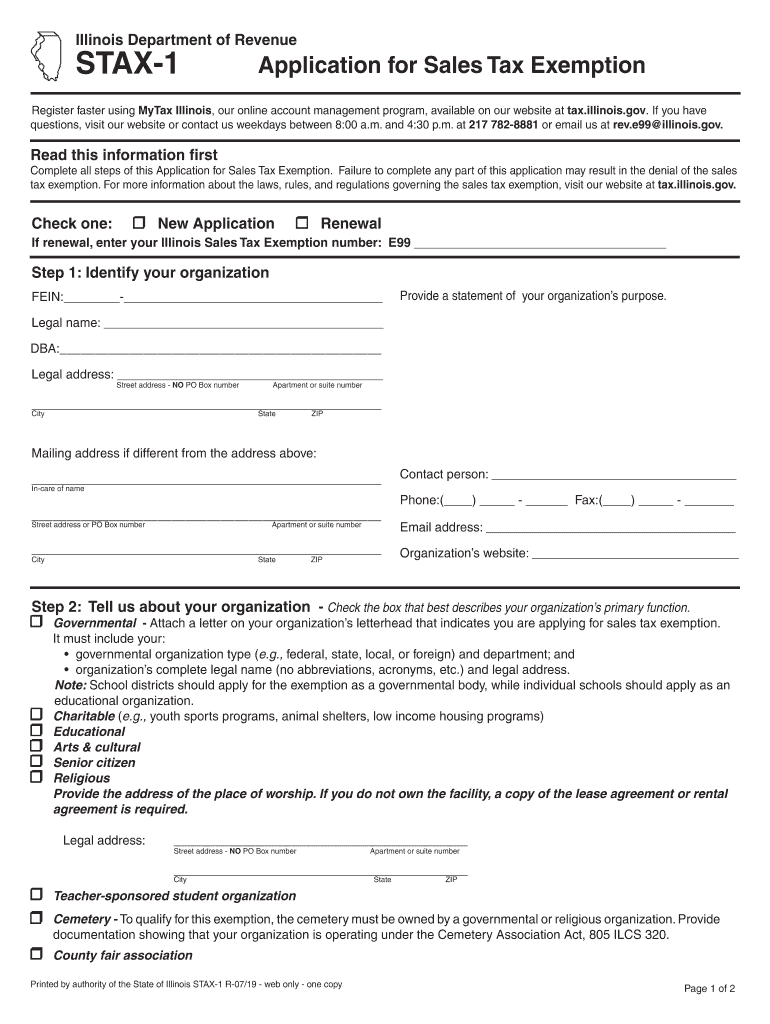

How to get a tax exempt card. Your organization must meet eligibility requirements as set forth by your state. R/tax view community ranking in the top 1% of largest communities on reddit how to get a tax exempt card this is my first time ever seeing. If airbnb is collecting, you need to contact.

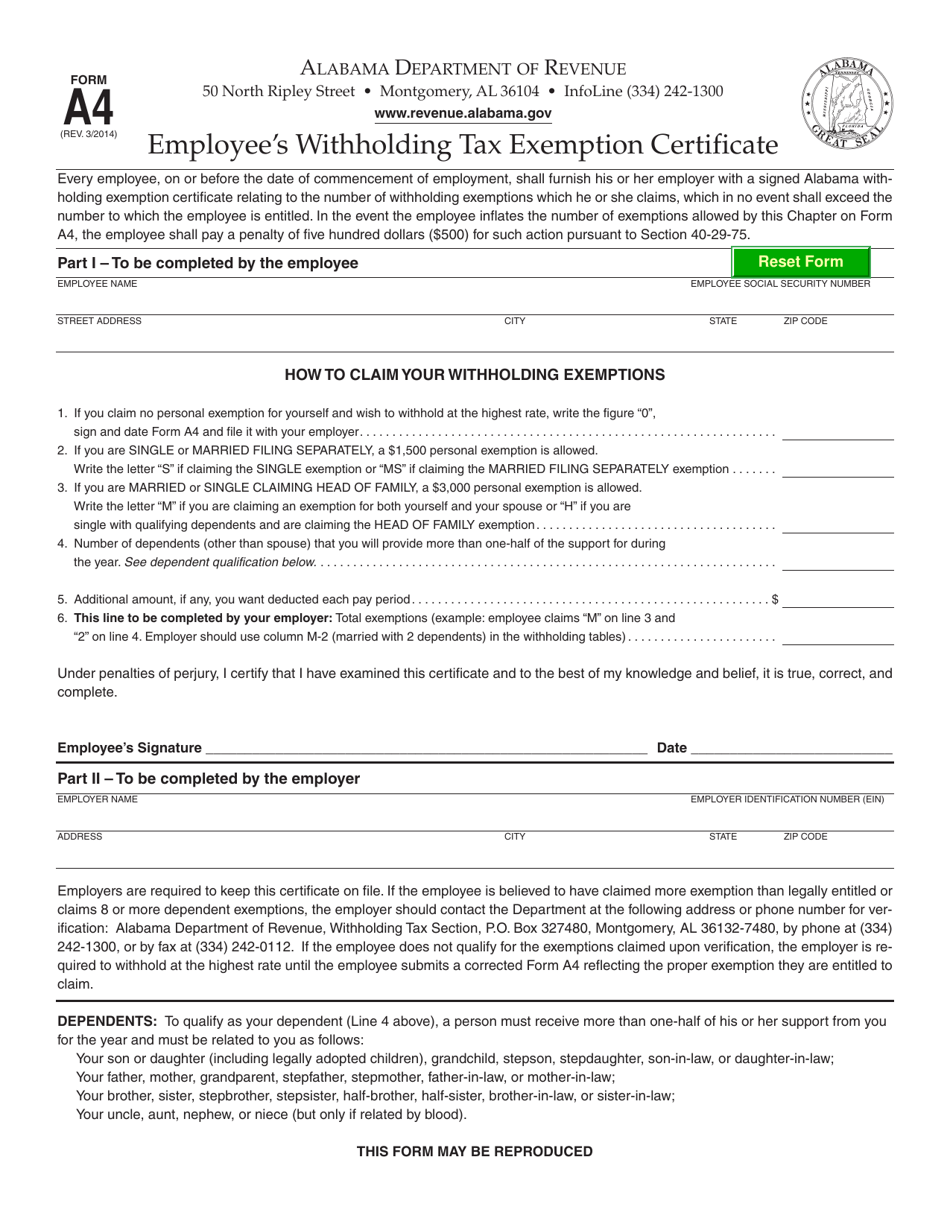

First, you need a letter certifying you are eligible. Payment for the purchase must be. Qualifying for walmart tax exempt status the first step is making sure your business or organization actually qualifies for sales tax exemption.

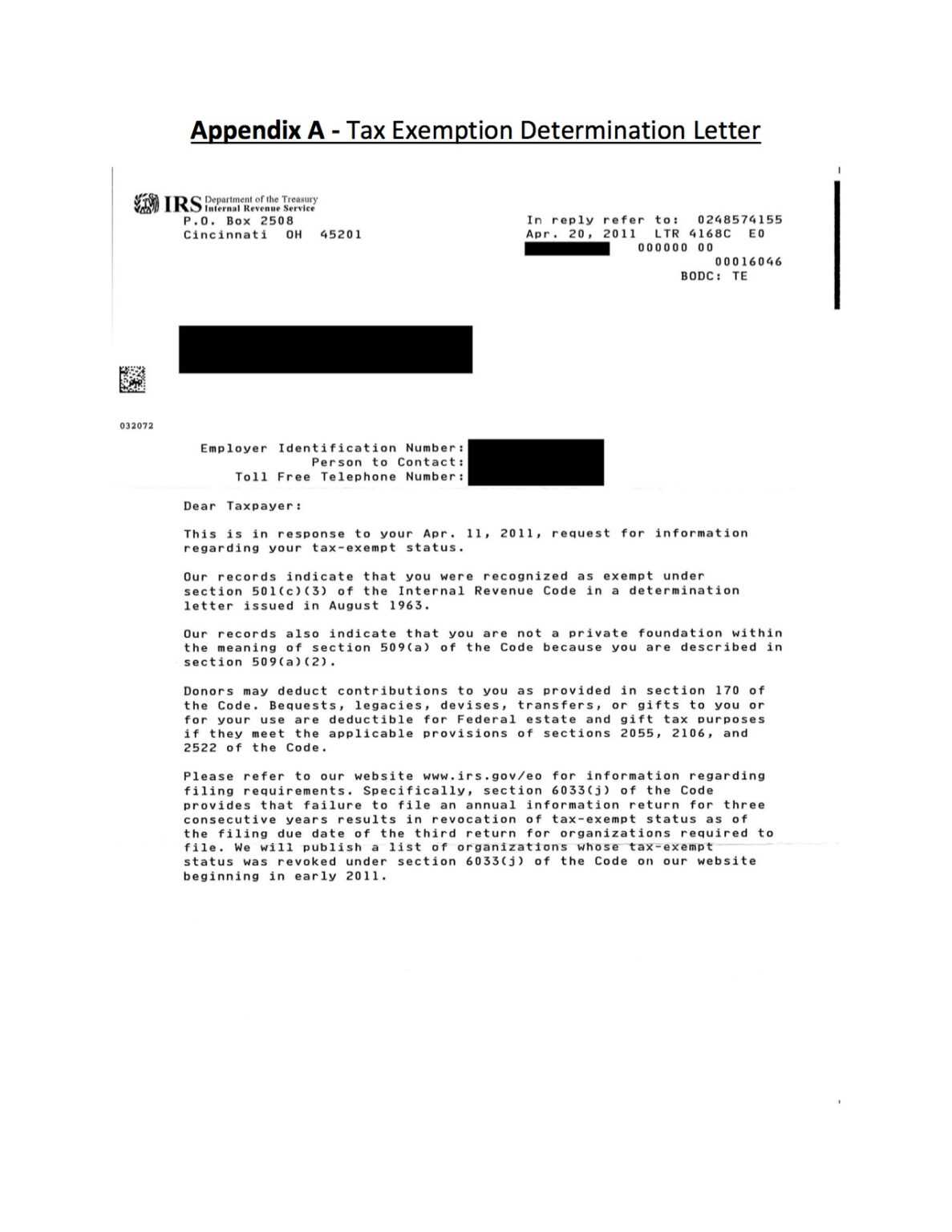

Department of state issues tax exemption cards to eligible foreign missions, accredited members and dependents on the basis of. You can apply for and receive a federal employers identification number by applying online at irs.gov. When approved, the nonprofit will not be required to pay federal.

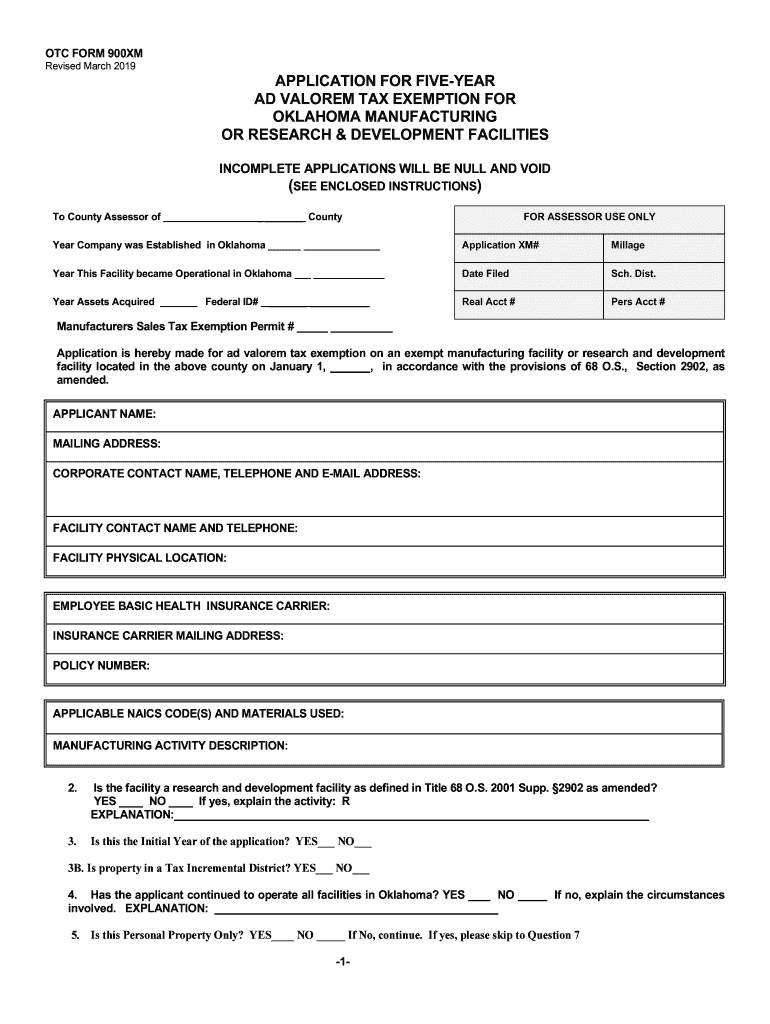

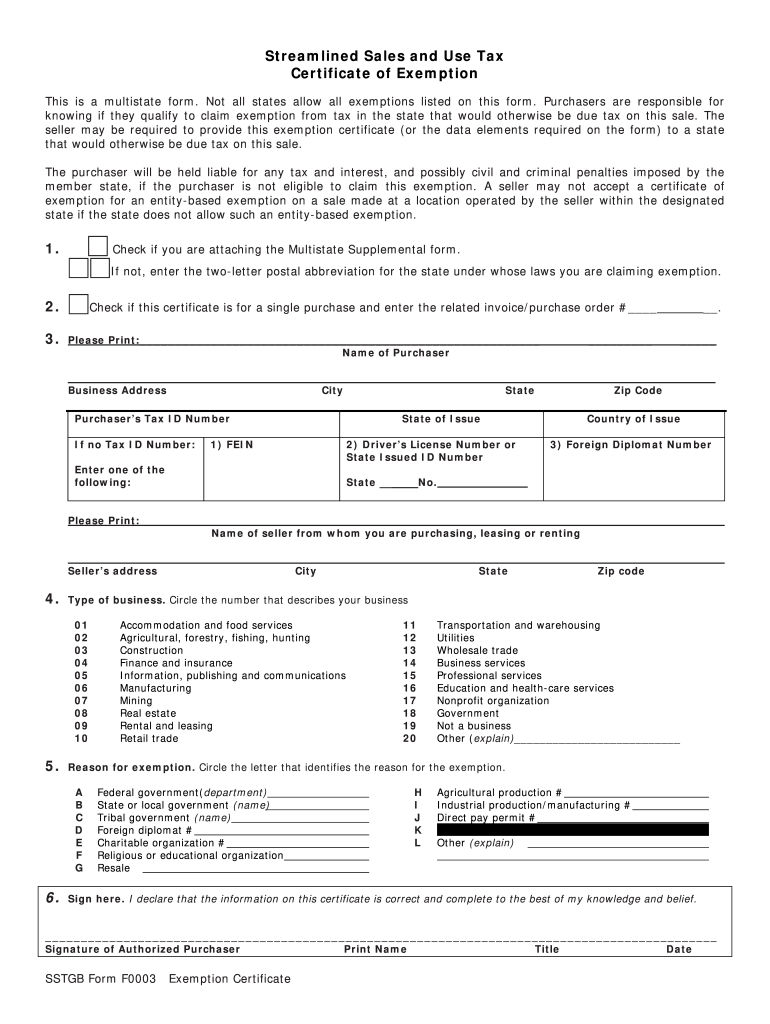

The internal revenue code specifically refers to exemption from federal income tax. Determine whether your business is eligible for a tax exempt card. Below are the steps you need to.

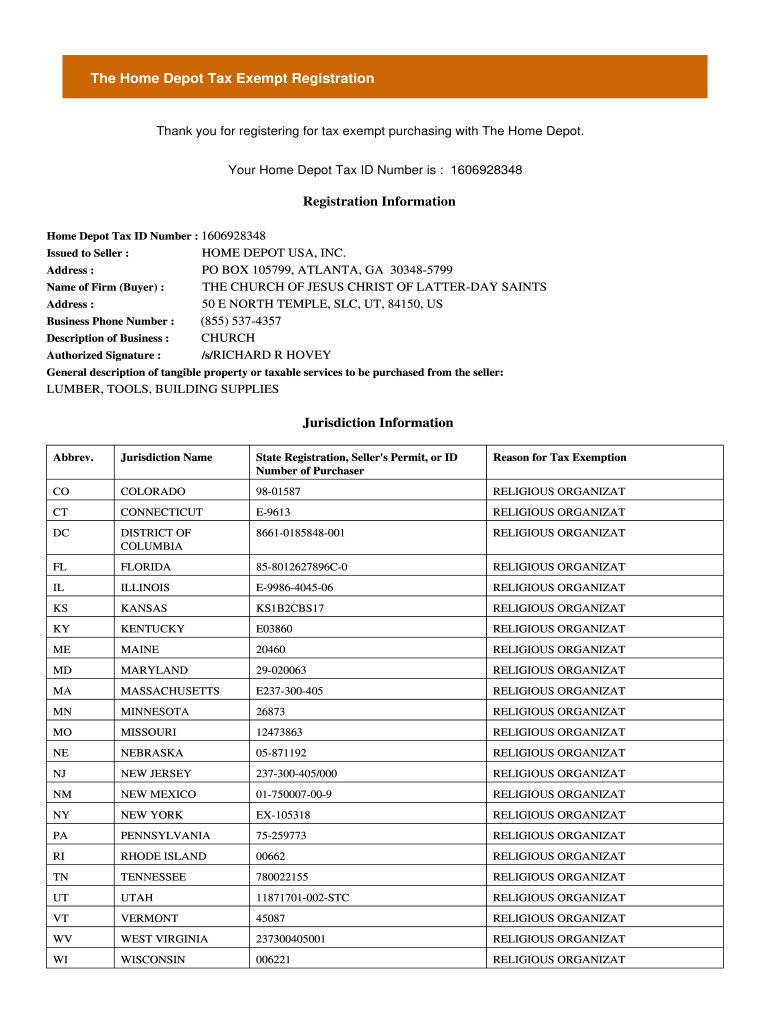

First, you need a letter certifying you are eligible. Provide a copy of the florida consumer’s certificate of exemption to the selling dealer to make tax exempt purchases or leases in florida. Tax exemption cards the u.s.

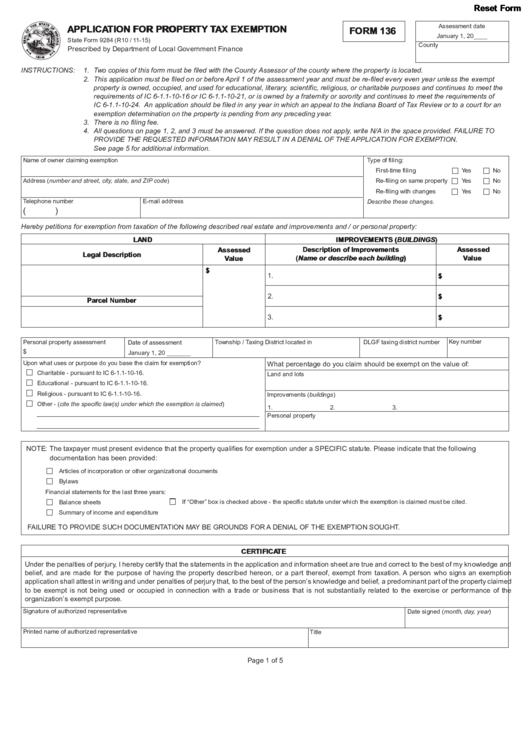

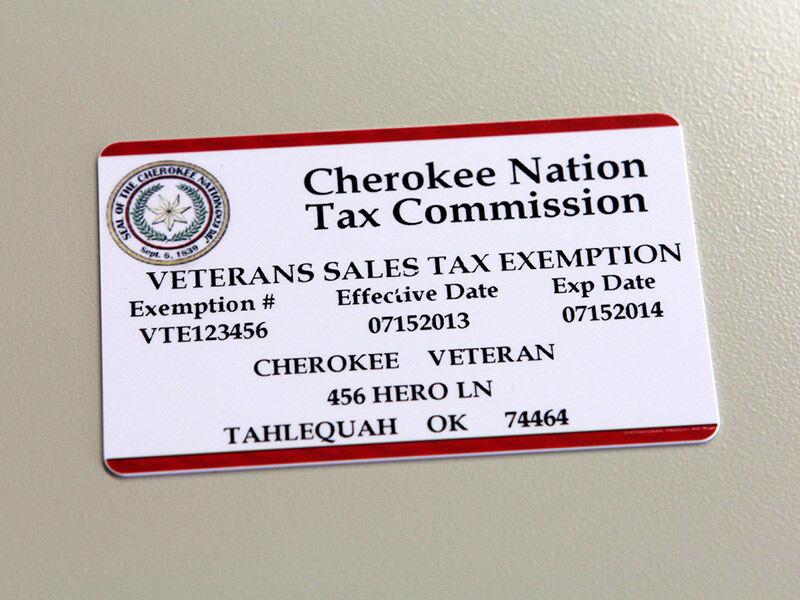

How do i get a card showing i'm exempt from oklahoma sales tax? Upon receipt of your new certificate, we will. The following exemptions require a different application form.

As of january 31, 2020, form 1023 applications for recognition of exemption must be submitted. The alternative plan, which has become known as biden’s “plan b ,” could forgive the student debt for as. I got my sales tax exempt card from walmart and i am taking you along for the ride!

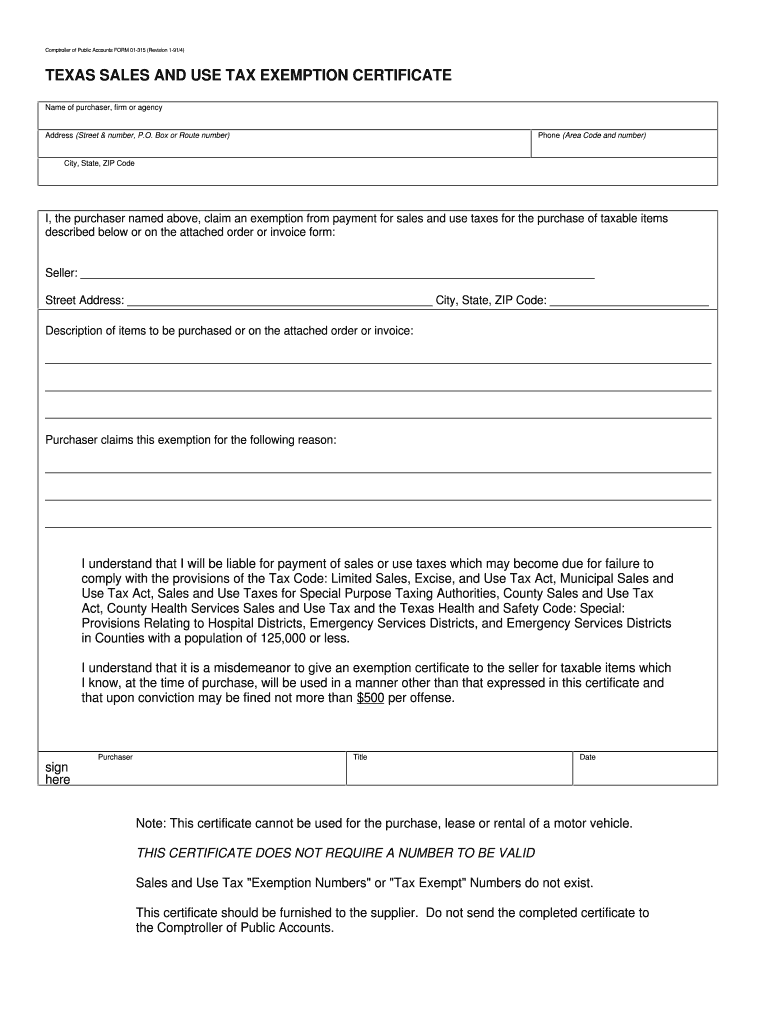

If the host is collecting the tax, you need to provide a tax exempt certificate of some kind, which the district should provide. The card is free. Tax exempt long forms.