Peerless Tips About How To Claim A Stock Loss

The q4 loss included various noncash charges.

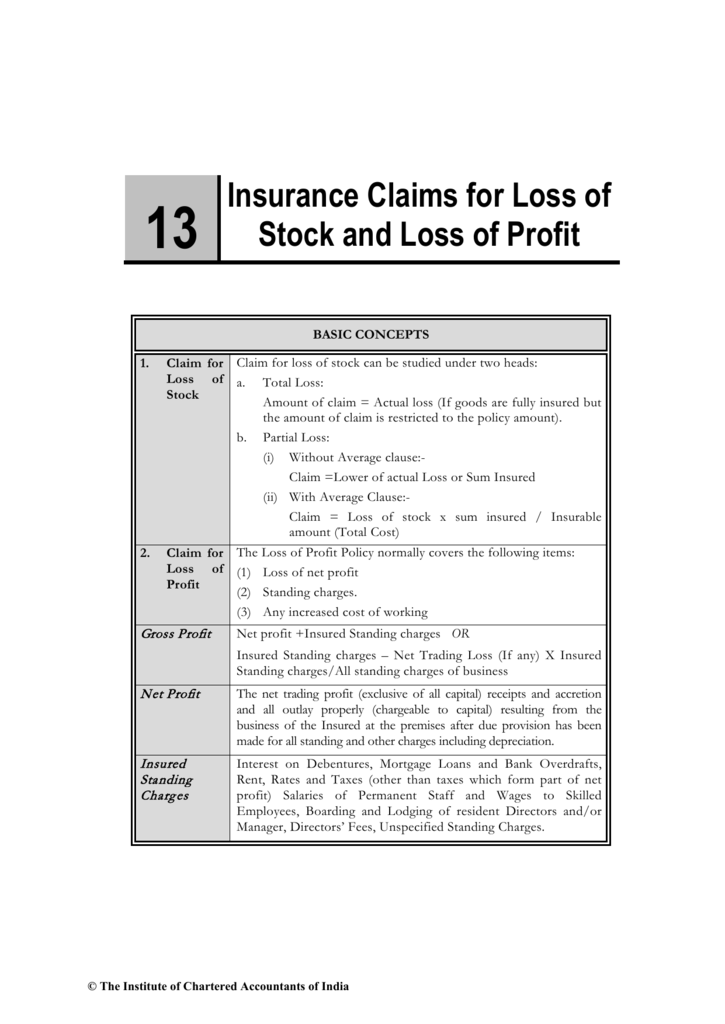

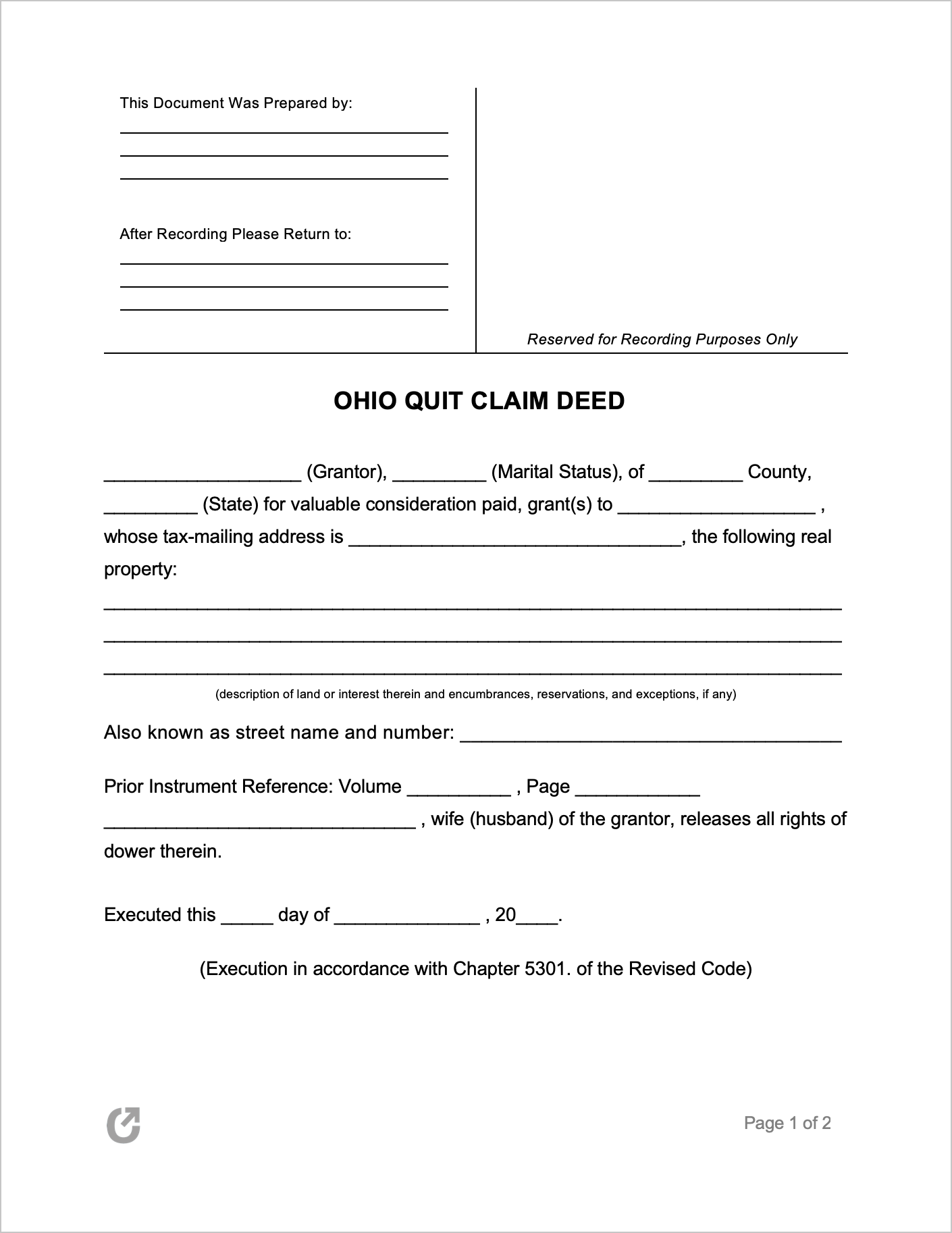

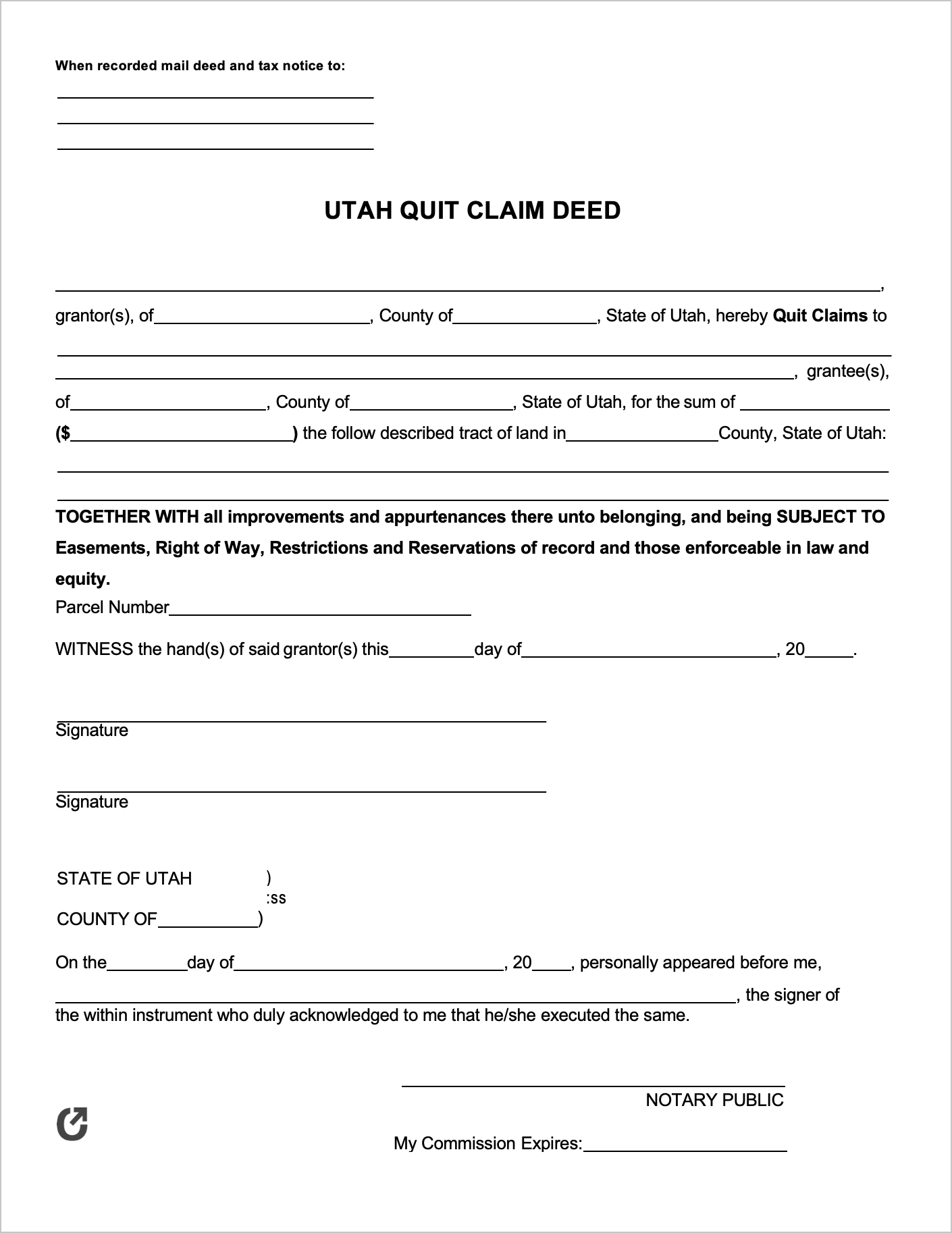

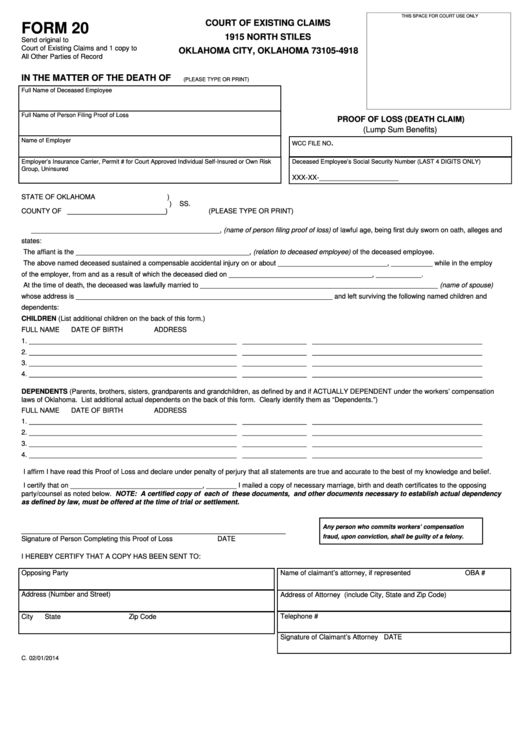

How to claim a stock loss. Learn more smart tax planning can save you a fortune on your tax bill. Form 1040x, amended tax return irs publication 550, investment income worthless means zero value before you can use this tax break, the stock must be totally. You must fill out form 8949 and schedule d with your tax return to deduct your stock market losses.

165 (g), which permits a loss deduction for a security that becomes worthless. Capital loss carryover: The general rule for deducting losses on worthless investment securities is found in sec.

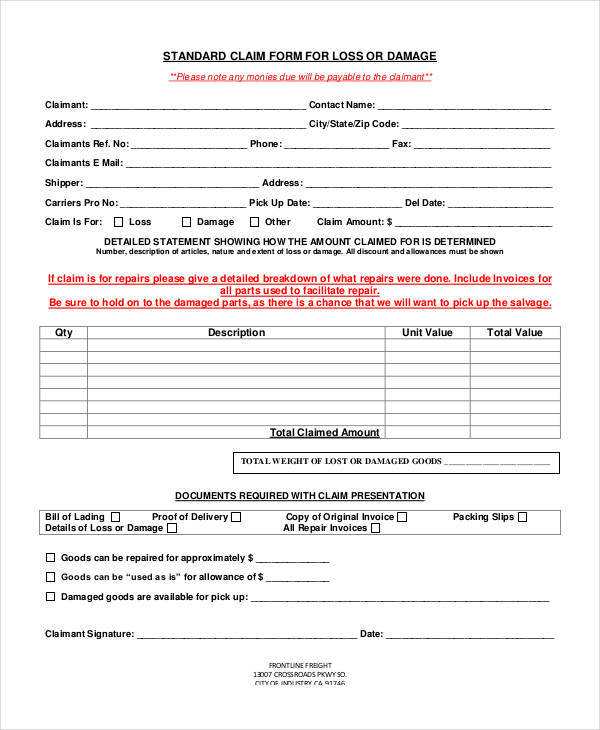

When you’re ready to claim the loss, you have to show it on schedule d as a capital loss. Proposed class action claims ai company's 'smoke and mirrors' to blame for sinking stock price. The rough calculation for determining your realized capital loss on a security is:

(this assumes you don’t qualify for an ordinary loss on certain small. The result is your realized. This suit was surfaced by law.com radar, alm's source.

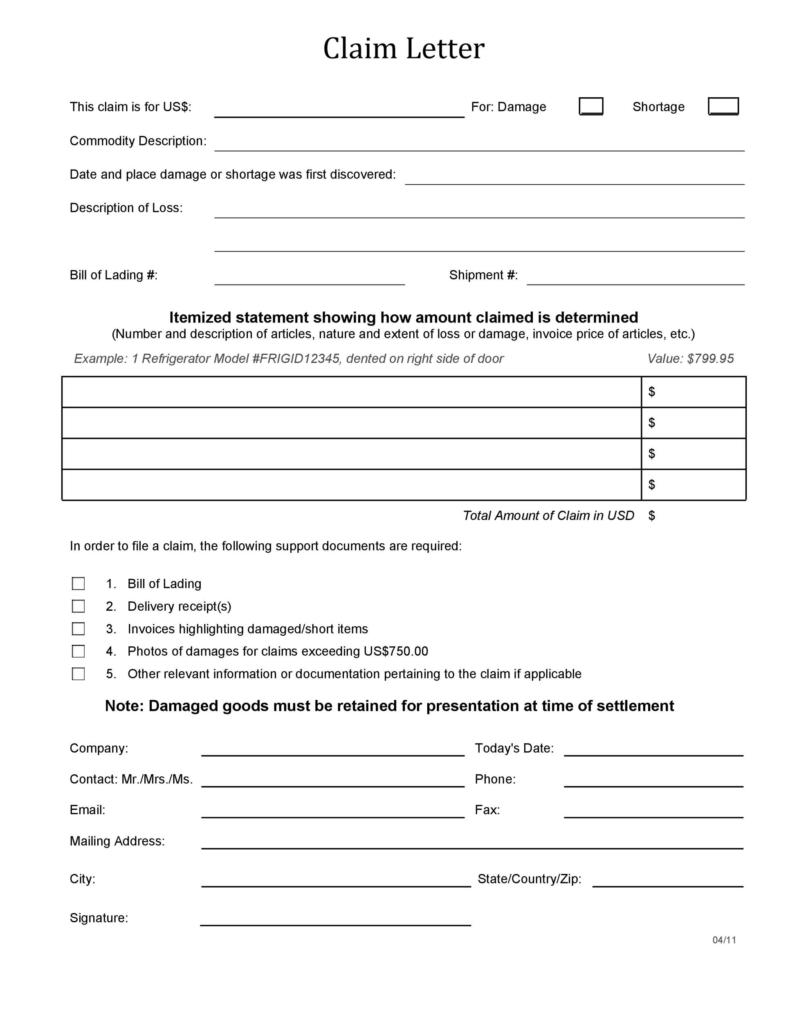

If you got caught up trading stocks and you sustained a capital loss, you can deduct this loss when filing your state and federal taxes. Typically, the asset sold at a. The net loss was $90.8 million, which at least is an improvement over 2022, with its $666.7 million in revenue and.

Schedule d is a relatively simple form and it will allow you. You can use capital losses (stock losses) to offset capital gains during a taxable year, says cfp®, aif®, clu®daniel zajac of the zajac group. It allows investors to claim an ordinary loss on the investment rather than a capital loss if.

You can choose to use the loss against a future capital gain by claiming the loss on line 25300 of your tax return (net capital losses of other years). Use schedule d to report realized gains and losses (gains and losses you made from selling stock). Section 1244 stock is a type of equity investment in a small business.

Understandably, you calculate your loss when you sell stock by subtracting what you paid for it from what you sold it for. At&t posted an update on thursday evening, saying that the company does not believe the outage was due to a cyberattack. In order to claim the loss, you must buy the new shares outside of the period that begins 30 days before and ends 30 days after the sale of the loss stock.

He carries forward the other $2,000 in losses to deduct in future years. Schedule d is an addition to the main tax return, form 1040.

Total costs and expenses were $944.2 million. Here's how to maximize your capital gains and losses, and how much you can write off each. Learn how to start and.